EAU CLAIRE, Wis., Mar 20, 2023 (SEND2PRESS NEWSWIRE) — Rystad Energy, one of North America’s most respected energy research firms, recently completed a second study of nearly 900 shale wells in the Permian basin in West Texas. The study compares wells completed using in-basin sand (IBS) with wells completed with northern white sand (NWS), says the Wisconsin Industrial Sand Association (WISA).

Although In-Basin Sand dominates the Permian Market, the study’s results suggest that even in the short term, the majority of wells would deliver higher productivity using Northern White Sand.

The study, the second in a series, examines three years of historical data obtained from nearly 900 West Texas Permian Basin shale wells. The latest Rystad Study shows that in 85% of the cases studied, the short-term cash benefits of completing wells with IBS were negated within the first year or two, with the productivity divergence growing yearly.

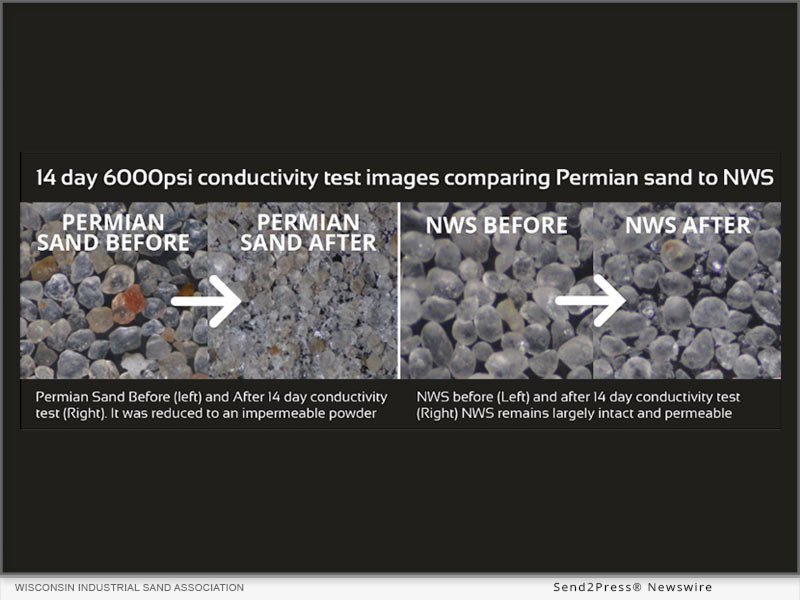

Penny Aschenbrenner of Material Spec Labs, which specializes in sand testing, said, “The physical properties of IBS and NWS proppants provide a logical explanation for the difference in production.”

Material Spec Labs uses API (American Petroleum Institute) testing methods to test frac sand for its customers.

“Our job is to test the sand for the physical properties the customer is paying for,” says Aschenbrenner. She states, “The concept isn’t new. It’s sometimes difficult to conceptualize proppant properties and their functionality due to the foreign nature of micro measurements. But if we relate the problem to something we are familiar with, the answer is obvious.”

Ashenbrenner was not surprised by the negative impact of IBS on the wells and questioned whether any technically capable engineer would be either, “The science is pretty simple,” Ashenbrenner states, “the sand is exposed to extreme pressures and conditions in a well. It is easy to see that the lower-strength sand will crush and possibly clog a well much sooner than a higher-quality proppant. That’s what you see in the lab, and it’s highly probable that it’s happening downhole.”

NWS became widely used when the shale revolution began because of its high strength, high purity, and very round silica sand was used to prop open the fractures induced by the hydraulic fracturing process. Hydraulic fracturing uses water, sand, and chemicals to fracture shale rock deep beneath the earth’s surface. Once the fracturing has occurred, the fluids are returned to the surface, and the sand remains to keep the fractures “propped” open, which is why the industry terms the sand: “proppant.”

The Rystad study challenges the industry’s most recent choices. Executives probably did the right thing at the right time for their stakeholders by adapting IBS. When oil and gas prices plummeted, producers had already spent their cash on growing production, with many outspending their cash flow by completing more wells than needed. This ultimately led to overproduction and caused prices to crash heading into the pandemic. By the time Covid hit, and prices crashed, many producers were running out of cash, perhaps staring down bankruptcy. Their only option was to reduce costs, and using IBS was an obvious, short-term solution.

IBS may have been a company-saving strategy, but its use carried an unforeseen long-term expense. As illustrated in the Rystad findings, decreased well productivity and longevity are now being felt by those companies, their shareholders, the mineral rights holders, and possibly, U.S. energy security in general. Despite the early indication that production would stay the same, according to the production data studied by Rystad, wells completed with IBS now reveal accelerated economic losses in the hundreds of thousands of dollars per well after only a few short years compared to wells completed with NWS. That spread only grows more significant as oil and gas prices increase.

Other explanations abound. Some industry CEO’s are now blaming the rock quality itself for accelerating declines in the past few years. Others fall back on well proximity, sometimes called the “Parent/Child” effect. The Rystad Study supports the observation that switching to IBS is highly correlated with accelerating decline rates.

The Rystad study suggests serious consideration of the science, and a revisit to the proppant decision choices. Higher energy prices and demand, the ongoing interest in energy independence, and safety and environmental considerations mandate that oil and gas wells run optimally. Mineral rights holders, energy investors, landowners, and energy workers have significant vested economic interests.

More Information:

The Rystad Study can be found at https://wisconsinsand.org/wp-content/uploads/sites/77/2023/03/20220907-Rystad-Energy-WISA-Final-Report-Anonymous.pdf

Material Spec Labs can be reached at https://www.materialspeclabs.com/

About WISA:

Based in Eau Claire, Wis., The Wisconsin Industrial Sand Association is an organization formed to promote safe and environmentally responsible sand mining standards, promote a fact-based discussion, and create a positive dialogue among the industry, citizens, and government officials. Learn more: https://wisconsinsand.org/.

Image 72DPI: https://wisconsinsand.org/wp-content/uploads/sites/77/2023/03/NWS-IBS-BeforeAfter.jpg

News Source: Wisconsin Industrial Sand Association

Related link: https://wisconsinsand.org/

This press release was issued on behalf of the news source, who is solely responsible for its accuracy, by Send2Press Newswire. To view the original story, visit: https://www.send2press.com/wire/energy-industry-experts-weigh-in-on-latest-rystad-energy-shale-well-study-indicating-potential-answer-for-accelerated-productivity-declines/