Tag: Reports and Studies

REPORT: Q2/25 Industrial Manufacturing Soars 31% for Planned Projects Over $100M; June Planned Industrial Projects Hit 141

JACKSONVILLE BEACH, Fla. /New York Netwire - National News/ -- Industrial SalesLeads announced today the June 2025 results for its new planned capital project spending report, highlighting the continued strong activity in the Industrial Manufacturing sector. According to the firm's research, 141 new industrial manufacturing projects were tracked in June 2025 alone, reflecting robust activity across North America.

New Marketing Industry Research Shows Direct Mail Outpaces Digital in 2025 Performance Gains

MINNEAPOLIS, Minn. /New York Netwire - National News/ -- Direct mail is proving its staying power, according to new industry research commissioned by Franklin Madison Direct and conducted by Circlebox. The 2025 Direct Mail Marketing Benchmark Report shows 67% of marketers saw improved direct mail performance over the past 12 months - the highest lift among all direct marketing channels, including email and social media.

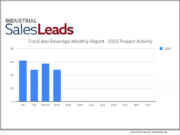

Food and Beverage Industry Rebounds in June with 56 New Industrial Planned Projects Igniting Growth After Decline

JACKSONVILLE BEACH, Fla. /New York Netwire - National News/ -- Industrial SalesLeads just released its June 2025 report, revealing a notable rebound in planned capital project spending for the North American Food and Beverage industry. After two months of decline, the sector saw a strong comeback with 56 new projects confirmed. June saw month-over-month growth across all categories with new construction up by 27%, expansion projects increasing by 66%, and renovations / equipment upgrades climbing by 40%.

Survey from Handy Recovery Advisor Shows Over 70% of U.S. Users Have Experienced Data Loss

SAN FRANCISCO, Calif. /New York Netwire - National News/ -- Handy Recovery Advisor, a trusted resource for data recovery tips and digital safety advice, has published the results of a nationwide survey of 1,000 U.S. adults. The report highlights how everyday users deal with data loss and how most don't take action until it's too late.

Refis, Product Shifts and Strong Agency Participation Define the June 2025 Market Advantage Report from Optimal Blue

PLANO, Texas /New York Netwire - National News/ -- Optimal Blue today released its June 2025 Market Advantage mortgage data report showing total lock volume rose 1.95% month-over-month (MoM), driven by increased refinance activity. Refinance share climbed from 16% to 18% of all locks as rate-and-term refinances jumped 17.4% MoM and 18.4% year-over-year (YoY). Cash-out refinances rose 8.1% from May and nearly 28% YoY.

May 2025 Industrial Manufacturing Near March Levels with 146 New Planned Capital Projects Heading into Summer

JACKSONVILLE, Fla. /New York Netwire - National News/ -- Industrial SalesLeads announced today the May 2025 results for its new planned capital project spending report for the Industrial Manufacturing industry. The report reveals a continuation of robust activity. The Firm, which tracks North American planned industrial capital project activity including facility expansions, new plant construction, and significant equipment modernization projects, confirmed 146 new projects in the Industrial Manufacturing sector for May.

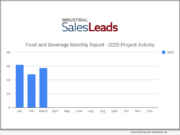

STUDY: Equipment Upgrades Drive the Food and Beverage New Industrial Planned Projects Growth in May 2025

JACKSONVILLE, Fla. /New York Netwire - National News/ -- Industrial SalesLeads released its May 2025 report on new planned capital project spending within the Food and Beverage industry. The Firm monitors planned industrial activity across North America, including facility expansions, new plant construction, and major equipment modernization projects. Research for the month confirms 43 new projects in the Food and Beverage sector, with equipment upgrades leading the way.

Optimal Blue Releases May Data Findings, Announces Expansion of Monthly Report for More Comprehensive 2025 Lender Profitability Insights

PLANO, Texas /New York Netwire - National News/ -- Optimal Blue today released the May 2025 edition of its now-expanded Market Advantage mortgage data report, which features newly added borrower profile and capital market datasets for a more comprehensive picture of early-stage mortgage activity and loan profitability. The enhancements come at a critical time for mortgage lenders navigating heightened interest rates, tighter margins, increased volatility and deepening affordability challenges.

Publishers Newswire’s ‘BOOKS TO BOOKMARK’ List for Q1/2025 Showcases 11 Interesting New Books Worth a Look

TEMECULA, Calif. /New York Netwire - National News/ -- Publishers Newswire (PNW), an online news publisher covering books, music, indie film, and software launched in 2004, today announced its latest quarterly "books to bookmark" list for Q1 (Jan.-March) 2025, noting 11 new and interesting "good reads" from small publishers released in 2025. These newly published books are often overlooked due to not coming from major traditional book publishing houses or celebrity authors.

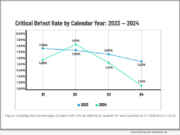

ACES Mortgage QC Industry Trends Report for Q4/CY 2024 finds quarterly defect rate falls to 1.16% as annual loan quality improves

DENVER, Colo. /New York Netwire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the fourth quarter (Q4) and calendar year (CY) of 2024. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

Industrial SalesLeads: 48 New Industrial Projects for Food and Beverage in April 2025

JACKSONVILLE BEACH, Fla. /New York Netwire - National News/ -- Industrial SalesLeads released its April 2025 report on planned capital project spending within the North American Food and Beverage industry, revealing a total of 48 new projects. Notably, renovations and equipment upgrades constituted 44% of this activity. The Firm's tracking encompasses facility expansions, new plant constructions, and key equipment modernization initiatives within the sector.

Optimal Blue’s April 2025 Market Advantage report shows stronger purchase activity, a shifting loan mix, and signs of investor caution

PLANO, Texas /New York Netwire - National News/ -- Optimal Blue today released its April 2025 Market Advantage mortgage data report showing total loan lock volume rose 3.2% month-over-month (MoM) as the spring homebuying season progressed, with purchase locks up 7.5% despite ongoing economic pressures.

Industrial SalesLeads released its April 2025 report on planned capital project spending in the Manufacturing construction industry

JACKSONVILLE BEACH, Fla. /New York Netwire - National News/ -- Industrial SalesLeads released its April 2025 report on planned capital project spending in the Manufacturing construction industry, highlighting a growing new project pipeline. The Firm's tracking of North American activity identified 133 new projects slated for development. This surge includes investments in facility expansions, the construction of new manufacturing plants, and significant equipment modernization projects.

2025/Q1 Homebuyer Intelligence Report from LenderLogix Shows Early 2025 Mortgage Market Momentum, Stronger Loan Engagement

BUFFALO, N.Y. /New York Netwire - National News/ -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home-buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process in the first quarter (Q1) of 2025.

iEmergent has released its analysis of 2024 Home Mortgage Disclosure Act (HMDA) data

DES MOINES, Iowa /New York Netwire - National News/ -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, has released its analysis of 2024 Home Mortgage Disclosure Act (HMDA) data in Mortgage MarketSmart. The insights, shared by iEmergent CEO Laird Nossuli, highlight a modest market recovery from 2023 alongside deepening disparities in borrower outcomes and a reshuffling of lender dynamics.

43 new assistance programs were added during the first quarter of 2025, says Down Payment Resource’s Q1 2025 HPI Report

ATLANTA, Ga. /New York Netwire - National News/ -- Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, today released its Q1 2025 Homeownership Program Index (HPI) report. The report saw the number of entities offering homebuyer assistance programs increase by 55 year-over-year (YoY). The number of programs increased by 43 during the first quarter, bringing the total number of available programs to 2,509.

Another Strong Showing to Round Out 2025/Q1 with 425 New Industrial Manufacturing Planned Projects

JACKSONVILLE BEACH, Fla. /New York Netwire - National News/ -- Industrial SalesLeads announced today the March 2025 results for the new planned capital project spending report for the Industrial Manufacturing industry. Research confirms 147 new projects in the Industrial Manufacturing sector. The company monitors planned industrial capital investments across North America, encompassing facility expansions, new factory builds, and major equipment upgrades.

Industrial SalesLeads Report: March 2025 Produced 57 New Food and Beverage Industry Planned Projects with Activity in Ohio, PA and S.D.

JACKSONVILLE BEACH, Fla. /New York Netwire - National News/ -- Industrial SalesLeads' March 2025 report on new planned capital project spending in the North American Food and Beverage industry has been released today. The report, which covers facility expansions, new plant construction, and significant equipment modernization, indicates 57 new projects.

Optimal Blue today released its March 2025 Market Advantage mortgage data report

PLANO, Texas /New York Netwire - National News/ -- Optimal Blue today released its March 2025 Market Advantage mortgage data report, showing a 24% surge in rate lock volume as early spring buyers returned to the market and homeowners jumped at the chance to refinance into lower rates. While still down 2% on a year-over-year (YoY) basis, purchase volumes were up 21% month-over-month (MoM). Rate-and-term and cash-out refinances jumped 52% and 20% MoM, respectively, together representing 25% of all lock activity.

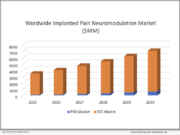

‘The Market for Implanted Pain Neuromodulation Systems: 2025-2030’ released by Neurotech Reports

SAN FRANCISCO, Calif. /New York Netwire - National News/ -- Neurotech Reports, the publisher of the newsletter Neurotech Business Report, announced the availability of a new market research report that forecasts the growth of the worldwide market for implanted pain neuromodulation systems. According to the newly published report, "The Market for Implanted Pain Neuromodulation Systems: 2025-2030," the worldwide market will be $3.37 billion in 2025, growing to $6.49 billion by 2030, which represents a 12% compound annual growth rate.