Tag: Mortgage Capital Trading Inc.

Collaboration Between Mortgage Capital Trading and Fannie Mae Improves Pricing for Mortgage Sellers

SAN DIEGO, Calif. /New York Netwire - National News/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced their integration with Fannie Mae's new Loan Pricing API. By combining various price factors and utilizing a broader set of data found in bid tapes, the new API provides greater price transparency on certain loans. This is the latest in a series of recent collaborations between MCT and Fannie Mae intended to provide additional benefit and value to mortgage secondary market participants.

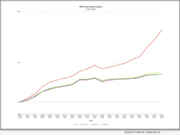

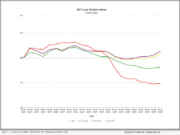

Mortgage Capital Trading (MCT) today announced a 27.91% increase in mortgage lock volume compared to the previous month

SAN DIEGO, Calif. /New York Netwire - National News/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced a 27.91% increase in mortgage lock volume compared to the previous month. Industry professionals and stakeholders are encouraged to download the full report for a detailed analysis.

MCT (Mortgage Capital Trading) Introduces Atlas: Generative AI Advisor for Mortgage Capital Markets

SAN DIEGO, Calif. /New York Netwire - National News/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the release of Atlas, an artificial intelligence (AI) advisor now available within the MCTlive! platform. Atlas serves as a virtual capital markets expert and high-quality educational resource for MCT's mortgage lender clients. With this launch, effective February 10, 2025, MCT continues its tradition of innovation in secondary marketing technology.

Mortgage Lock Volume Stays Flat in Latest MCT 2025 February Indices

SAN DIEGO, Calif. /New York Netwire - National News/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 0.12% decrease in mortgage lock volume compared to the previous month. Industry professionals and market enthusiasts are encouraged to download the complete report for a deeper understanding of the latest market trends and dynamics.

Mortgage Capital Trading Unveils MSRlive! 4.0, Offering New Enhancements to MSR Reporting and Transparency

SAN DIEGO, Calif. /New York Netwire - National News/ -- Mortgage Capital Trading (MCT), the de facto leader in innovative mortgage capital markets technology, today announced the release of MSRlive! 4.0, a groundbreaking enhancement to its mortgage servicing rights (MSR) valuation platform. The latest version offers mortgage servicers an unprecedented level of transparency and business intelligence, equipping portfolio managers with powerful new tools to assess and optimize their

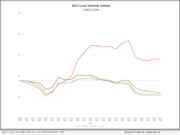

Mortgage Capital Trading (MCT) Reports 16% Decrease in Mortgage Lock Volume Amid Market Dynamics

SAN DIEGO, Calif. /New York Netwire - National News/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 16.7% decrease in mortgage lock volume compared to the previous month. Industry professionals and market enthusiasts are encouraged to download the complete report to gain comprehensive insights into the evolving market dynamics.

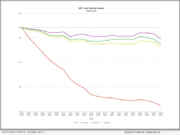

MCT (Mortgage Capital Trading) Reports a 15% Decrease in Mortgage Lock Volume Amid Higher Rates

SAN DIEGO, Calif. /New York Netwire - National News/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, has announced a 15.12% decrease in mortgage lock volume compared to the previous month. The data, reflecting current market dynamics, is available in MCT's latest report, which offers in-depth analysis and insights for industry professionals and stakeholders.

MCT Announces 2.5% Increase in Mortgage Lock Volume Despite October 2024 Market Volatility

SAN DIEGO, Calif. /New York Netwire - National News/ -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, reported a 2.5% increase in mortgage lock volume compared to the previous month. Mortgage market professionals and industry enthusiasts are invited to download MCT's comprehensive report to gain deeper insights into the current market dynamics.

MCT Empowers Mortgage Hedging Performance with Customized Spec Durations

SAN DIEGO, Calif., Oct. 24, 2024 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today an improvement to functionality through customizable duration analysis for specified loan products. Mortgage lenders using the comprehensive capital markets platform MCTlive! now have the ability to increase, review, and refine the granularity of their spec durations, leading to more precise hedging and reduced basis risk.

MCT Expands MSR Valuation Options with AD&Co Prepayment Model

SAN DIEGO, Calif., Oct. 8, 2024 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the integration of the LoanDynamics Model (LDM) from Andrew Davidson & Co. (AD&Co) into their mortgage servicing rights (MSR) valuation software. LDM is a well-respected prepayment model for residential mortgages that will complement MCT's proprietary prepayment model in MSRlive!

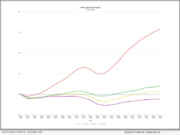

MCT Reports 3% Increase in Mortgage Lock Volume, Refinance Activity Buoys Market

SAN DIEGO, Calif., Oct. 3, 2024 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 3.17% increase in mortgage lock volume compared to the previous month. The report highlights key market dynamics, offering industry professionals valuable insights. Industry professionals and enthusiasts are invited to download the complete report for comprehensive insights into the market dynamics.

MCT Reports a 3% Increase in Mortgage Lock Volume Backed by Increasing Refinance Activity

SAN DIEGO, Calif., Sept. 4, 2024 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 3.33% increase in mortgage lock volume compared to the previous month. Despite a larger increase in rate/term volume, total mortgage volume remains relatively flat.

Patented Technology Allows Mortgage Buyers to Transact with Any Seller on MCT Marketplace

SAN DIEGO, Calif., Aug. 8, 2024 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced that the company has been awarded a patent for the security spread commitment used in the industry's largest mortgage asset exchange: MCT Marketplace. The security spread commitment transforms loan auctions, turning shadow bids into executable prices.

MCT Reports a 6% Mortgage Lock Volume Decrease in Latest Report

SAN DIEGO, Calif., Aug. 2, 2024 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a decrease of 5.67% in mortgage lock volume compared to the previous month. Industry professionals and enthusiasts are invited to download the complete report for comprehensive insights into the market dynamics.

MCT Integrates with Fannie Mae’s Mission Score API and New Product Grids to Empower Originators to Take Advantage of Market Incentives for Mission-oriented Lending

SAN DIEGO, Calif., June 27, 2024 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced the launch of new integrations with Fannie Mae's Mission Score application programming interface (API) and Mission Score 2 and 3 product grids that provide better transparency and pricing for mortgages aligned with Fannie Mae's mission objectives.

MCT and Lender Price Join Forces to Improve Mortgage Pricing with Loan-Level MSR Values

SAN DIEGO and PASADENA, Calif., June 13, 2024 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading (MCT®), the de facto leader in innovative mortgage capital markets technology, and Lender Price, the first cloud-native provider of mortgage pricing technology, have partnered to provide mortgage lenders using the Lender Price product and pricing engine (PPE) with loan-level MCT MSR values. MCT's industry-leading mortgage servicing rights (MSR) grids allow Lender Price PPE clients to be more granular, profitable, and efficient when generating their front-end borrower pricing and managing their MSR portfolio.

MCT Reports A 7% Mortgage Lock Volume Increase In Latest Indices Report

SAN DIEGO, Calif., June 10, 2024 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today an increase of 6.78% in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

New Solution Connects API-Driven Back-End Execution to Front-End Pricing with Industry-First Features

SAN DIEGO, Calif., May 9, 2024 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the release of the Base Rate Generator, an industry-changing solution that allows mortgage lenders to directly inform their front-end rate sheet pricing with their back-end capital markets executions. By combining live agency API connections, co-issue executions, aggregator pricing, and custom TBA indications, the MCT Base Rate Generator allows mortgage lenders to improve margin management and competitive performance.

MCT Reports A 2% Lock Volume Increase Despite Rising Rates

SAN DIEGO, Calif., May 7, 2024 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today reported a 1.87% increase in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

MCT Launches Complete Best Execution, Now Including Fully Integrated Retain vs. Release MSR Decisioning

SAN DIEGO, Calif., April 18, 2024 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, proudly introduces a game-changing advancement: a Best Ex for Released and Retained all in one platform!