Tag: loan origination software

Shore United Bank contracts Dark Matter Technologies for its mortgage business for AIVA AI virtual assistants

JACKSONVILLE, Fla. /New York Netwire - National News/ -- Dark Matter Technologies (Dark Matter®), an innovative leader in mortgage technology backed by time-tested loan origination software and leadership, announced today that Shore United Bank (Shore United), a community bank founded in 1876, has selected the Empower® LOS and select AIVA® AI virtual assistants from Dark Matter to streamline its mortgage lending operations and offer additional support for integrations.

Dark Matter Technologies unveils Horizon User Conference agenda

JACKSONVILLE, Fla., Feb. 15, 2024 (SEND2PRESS NEWSWIRE) -- Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced the agenda for its Horizon User Conference. Open to Dark Matter clients and partners, the conference will take place at the Fontainebleau Miami Beach Hotel on April 24-25.

Dark Matter Technologies adds mortgage technology veteran Tony Fox as chief of client engagement

JACKSONVILLE, Fla., Jan. 31, 2024 (SEND2PRESS NEWSWIRE) -- Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced industry veteran Tony Fox as its chief of client engagement.

Publix Employees Federal Credit Union inks contract with Dark Matter Technologies to modernize mortgage operations

JACKSONVILLE, Fla., Nov. 28, 2023 (SEND2PRESS NEWSWIRE) -- Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced a contract with Lakeland, Florida-based Publix Employees Federal Credit Union (PEFCU). The signing is the first under Dark Matter's new corporate structure and reflects the growing footprint of the company's popular Empower(r) Loan Origination Platform in the credit union sector.

Dark Matter Technologies adds mortgage technology veteran Michael Housch as chief risk and information security officer

JACKSONVILLE, Fla., Oct. 10, 2023 (SEND2PRESS NEWSWIRE) -- Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced the appointment of Michael Housch as chief risk and information security officer. Housch, a C-suite and information security veteran of two and a half decades, joins Dark Matter following an eight-year stint with Black Knight, Inc (acquired by Intercontinental Exchange).

OpenClose Launches Mobile Assist™ Native Mobile App Platform

WEST PALM BEACH, Fla., Dec. 8, 2021 (SEND2PRESS NEWSWIRE) -- OpenClose, the leading fintech provider of mortgage software solutions for banks, credit unions and mortgage lenders, today announced the launch of its native mobile app platform, Mobile Assist which adds features and functionality to make originators more successful with a real-time omnichannel device platform.

SimpleNexus launches ConnectUs Chat to facilitate real-time loan file collaboration between loan teams, borrowers and real estate agents

LEHI, Utah, July 8, 2020 (SEND2PRESS NEWSWIRE) -- SimpleNexus, developer of the leading digital mortgage platform for loan officers, borrowers and real estate agents, today announced the release of SimpleNexus ConnectUs Chat, a messaging feature that enables real-time loan file collaboration.

SimpleNexus Integrates with Reggora, Enabling Loan Originators to View and Manage Appraisals on the Go

LEHI, Utah, Oct. 23, 2019 (SEND2PRESS NEWSWIRE) -- SimpleNexus, developer of the leading digital mortgage platform for loan officers, borrowers and real estate agents, today announced it has partnered with Reggora, the leading automated appraisal technology for mortgage lenders and appraisers in delivering a range of origination solutions for the mortgage industry.

DocMagic and LendingPad Integrate for Easy, Compliant Document Preparation and eSigning

TORRANCE, Calif., June 26, 2019 (SEND2PRESS NEWSWIRE) -- DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, announced that it has completed an integration with cloud-based loan origination system (LOS) provider LendingPad from WEI Technology LLC, offering its document preparation services directly from within the LendingPad environment.

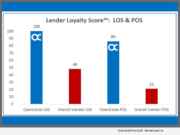

OpenClose LOS Platform, POS System and PPE Receives the Highest Overall Satisfaction and Lender Loyalty Score in STRATMOR’s New ‘Technology Insight Study’

WEST PALM BEACH, Fla., March 14, 2019 (SEND2PRESS NEWSWIRE) -- OpenClose, an industry-leading multi-channel loan origination system (LOS) and digital mortgage fintech provider, announced that STRATMOR Group's most recent Technology Insight Survey ranked the company's LOS platform, point-of-sale (POS) system, and product and pricing engine (PPE) as having the highest Overall Satisfaction and Lender Loyalty Score out of any vendor surveyed in the mortgage industry.

Ascend Federal Credit Union Automates its Residential Mortgage Lending Business with OpenClose’s LenderAssist LOS and DecisionAssist PPE

WEST PALM BEACH, Fla., April 24, 2018 (SEND2PRESS NEWSWIRE) -- OpenClose(R), an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced that Ascend Federal Credit Union (Ascend) is leveraging its LenderAssist(TM) LOS platform and DecisionAssist(TM) product and pricing engine (PPE). OpenClose's completely browser-based solution has delivered additional efficiencies and heightened service levels for the credit union's growing mortgage lending division.

LendingQB Makes FormFree’s Award-Winning AccountChek Asset Verification Part of Its ‘Lean Lending’ Loan Origination Software

ATHENS, Ga., Feb. 20, 2018 (SEND2PRESS NEWSWIRE) -- FormFree today announced the availability of its AccountChek(R) automated asset verification service within LendingQB's web-based loan origination software (LOS). The integration enables lenders to order AccountChek Asset Reports directly from LendingQB's verifications dashboard.

OpenClose Bolsters Software Integration and Support Teams

WEST PALM BEACH, Fla., Feb. 16, 2018 (SEND2PRESS NEWSWIRE) -- OpenClose(R), an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced that it has added staff to its integration and customer support departments. The new hires will help enhance OpenClose's existing software products, facilitate digital mortgage processes, produce fintech-level innovation and provide excellence in customer support. The company also recently added three senior software engineers to its development team.

OpenClose Launches Corporate Website to Reflect New Positioning of its Enterprise-class, Multi-channel LOS and Mortgage Software Solutions

WEST PALM BEACH, Fla., June 26, 2017 (SEND2PRESS NEWSWIRE) -- OpenClose, a multi-channel loan origination system (LOS) and mortgage software solutions provider, announced it unveiled a new corporate website to better position the company's expanded enterprise-class solution set, customer profile focus and long-term value proposition.

IDS Adds Pushback Notifications to Interface with Byte Software

SALT LAKE CITY, Utah, June 20, 2017 (SEND2PRESS NEWSWIRE) -- Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has added pushback notifications to its existing interface with BytePro Enterprise, the flagship loan origination software (LOS) platform from Byte Software. Through this enhancement, BytePro users will receive mortgage documents and fulfillment status notifications within the LOS platform.

Up-and-comer ubermortgage Embraces Home-Equity Conversion Mortgage (HECM) with Technology from ReverseVision

SAN DIEGO, Calif., June 13, 2017 (SEND2PRESS NEWSWIRE) -- ReverseVision, the leading technology provider for the reverse mortgage industry, has formed a partnership with ubermortgage Inc. to support the budding lender's increasing demand for home-equity conversion mortgages (HECMs) with its RV Exchange (RVX) loan origination technology.

FormFree Names Douglas Brewer Director of its Enterprise Architecture

ATLANTA, Ga., June 1, 2017 (SEND2PRESS NEWSWIRE) -- FormFree today announced the appointment of senior software developer Douglas Brewer to the role of director of enterprise architecture. Brewer, who first joined FormFree in 2014, will be responsible for managing the retention and growth of FormFree's software development team, overseeing enterprise software design and ensuring the quality and timely delivery of software updates.

Atlantic Coast Mortgage Chooses ReverseVision’s RVX Loan Origination Software for New HECM Division

SAN DIEGO, Calif., April 4, 2017 (SEND2PRESS NEWSWIRE) -- ReverseVision, the leading provider of software and technology for the reverse mortgage industry, today announced that Atlantic Coast Mortgage (ACM) has selected RV Exchange (RVX) loan origination software (LOS) to support its new home-equity conversion mortgage (HECM) division.

ReverseVision Named to HousingWire’s HW TECH100 for Second Time

SAN DIEGO, Calif., March 2, 2017 (SEND2PRESS NEWSWIRE) -- ReverseVision, the leading provider of software and technology for the reverse mortgage industry, today announced it has been named to HousingWire's HW TECH100(TM) list of the housing economy's most innovative technology companies for a second time. Previously recognized in 2015, ReverseVision is the only reverse mortgage loan origination software (LOS) provider to be selected for the prestigious award.

Simplifile Integrates Collaboration, Post Closing Services with LendingQB

PROVO, Utah, Jan. 18, 2017 (SEND2PRESS NEWSWIRE) -- Simplifile, a leading provider of real estate document and data collaboration and recording technologies for lenders, settlement agents, and counties, today announced the integration of its Collaboration and Post Closing services with LendingQB, a provider of 100 percent web browser-based, end-to-end mortgage loan origination software.